U.S. stocks ended a holiday-shortened four-day trading week essentially where it began. The S&P 500 finished lower on Friday, ending at 2,099.13 versus 2,099.06 a week earlier, after a disappointing May payrolls report showed the economy added the fewest new jobs since September 2010. Just 38,000 new jobs were added last month. While the unemployment rate fell from 5% to 4.7%, it declined mostly because more Americans dropped out of the labor force. The report triggered concerns about consumer confidence and the future pace of consumer spending, causing the benchmark equity index to retreat from its seven-month high and the safer asset havens of gold and Treasuries to rally.

For the week, the S&P 500 rose +0.04%; the Dow Industrials fell -0.37%; and MSCI EAFE (developed international) gained +0.18%.

What We’re Reading

Yellen Urges To Not Overreact On Jobs -- CNBC

Brexit Polls Lean Toward Brexit -- CNBC

Iran's Oil Exports Expand More Quickly -- Reuters

Chart of the Week: Interpreting May Payrolls; Risks Skewed to the Downside

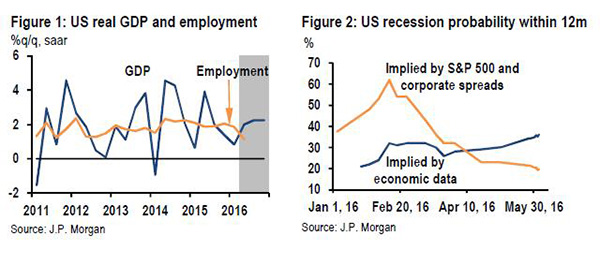

There are three messages to take from the U.S. May employment report. First, labor demand is waning, as job growth (adjusted for the Verizon strike effect) slowed to a 127,000 monthly average pace over the past three months (Figure 1). Second, hopes for a sustained pickup in labor supply were dashed as the participation rate has now retraced most of its recent rise. Job growth is still running faster than the underlying trend in the labor force and the US unemployment rate is now at an expansion low of 4.7%. Third, tight labor markets look to be lifting labor costs. Average hourly earnings are tracking 3% annualized this quarter, an outcome that would match its high for this expansion.

JPMorgan said Friday's job report validates their concern that firms might turn more cautious and that a run of stronger labor income gains may be coming to an end. As such, JP Morgan's outlook that U.S. growth rises above 2% during second-half of 2016 places greater weight on households cushioning the impact of slowing job growth and rising energy prices with a decline in the saving rate. Consumption news has been upbeat with strong April spending readings this past week and yet, while their forecast is unchanged, the risks have skewed to the downside.

Indeed, JPMorgan's recession probability tracker suggests that risks are creeping higher with the probability of a recession in the next 12 months reaching 36% this past week (Figure 2). It is important to note that their discomfort outlook view contrasts notably with financial markets, where implied recession probabilities have moved lower. To sum things up, the Fed likely shares JPMorgan's tracker discomfort and is therefore likely to remain on hold until they gain confidence that the expansion is on firmer footing. A June hike is most likely off the table, and a sharp data pickup in activity is needed for a July hike to be realized.

Articles chosen and summarized by the Cetera Investment Management team. Cetera Investment Management provides investment management and advisory services to a number of programs sponsored by First Allied Securities and First Allied Advisory Services. Cetera Investment Management individuals who provide investment management services are not associated persons with any broker-dealer. International investing involves additional risk, including currency fluctuations, political or economic conditions affecting the foreign country, and differences in accounting standards and foreign regulations. These risks are magnified in emerging markets. Investing in companies involved in one specified sector may be more risky and volatile than an investment with greater diversification.